by Aimeric Atsin

The 2018 Fall Economic Statement by the Federal Government projects budget deficits and continued increase in the public debt for the next five years. The question of public debt has always been the subject of much discussion, especially during the election year. In this brief, we assess the potential implications of rising public debt for Canada’s medium-term outlook.

In general, government entities use two primary sources of funding to cover their expenses: taxation and borrowing. When the amount of money realized through taxation is not enough to fully fund the government’s various commitments, they borrow money. Governments raise funds from the public or institutions by selling securities, such as bonds on the financial market. The cumulative total of these state obligations is called "public debt".

Stakeholders in public debt management and their roles

The management of Canada's public debt is done jointly by the Department of Finance and the Bank of Canada.

The Department of Finance as a central agency, helps the Government of Canada develop and implement economic, fiscal, tax, social, security, international and financial sector policies and programs.[1] As for the Bank of Canada, according to the Bank of Canada Act, Its principal role is to promote the economic and financial welfare of Canada.[2]

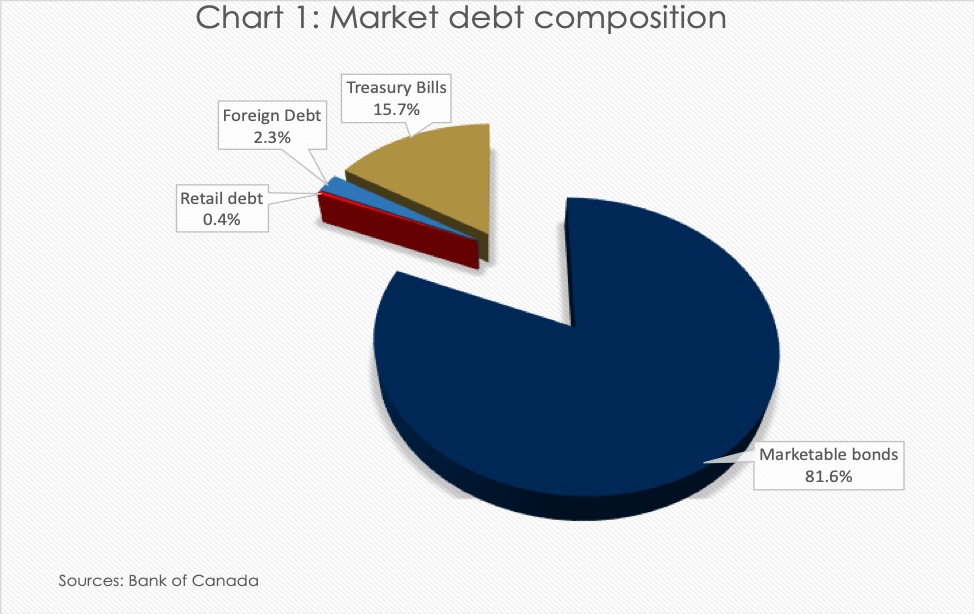

The Department of Finance has three main types of debt instruments. In particular, there are short-term debt securities (less than one year), medium-term debt (2-10 years) and long-term debt securities (11-40 years): "Marketable federal Bonds" and "Canada Savings Bonds" (see Lapointe (2018) for more information on the definitions of federal debt in Canada).

In tandem with the Department of Finance, the federal government's fiscal agent [3]acts as the banker and treasury manager. Besides this, the Bank of Canada is in charge of managing Canada's Foreign Exchange Reserves, the Domestic Debt Program, and the Retail Debt Program.[4]

Fiscal deficit financing operations affect the Bank of Canada's monetary policy since the allocations of debt securities on the primary market result in cash outflows from the banking sector into government accounts at the Bank of Canada. Therefore, it takes into account the impact of these operations on the banking system and its monetary policy priorities.

The Bank of Canada submits its recommendations to the Ministry of Finance, which sets the broad lines of debt policy and advises on the issuance, distribution, and repurchase of government securities in domestic and foreign debt markets.

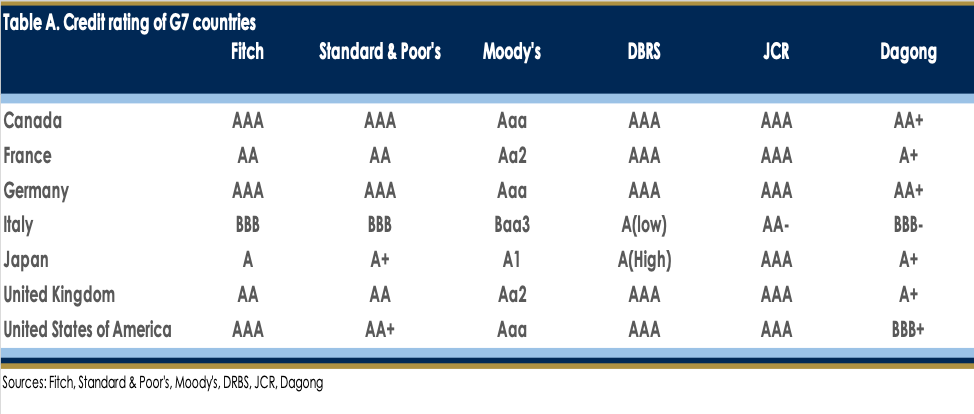

In Canada, the government tends to raise funds predominantly through medium and long-term bonds.[5] T-Bills are much less prevalent than in some other countries (Argentina or Turkey for example) where the government does not enjoy much confidence from investors. Canada’s credit rating is the highest among the G-7 countries (Table A).

Overview of the Canadian fiscal and economic outlook

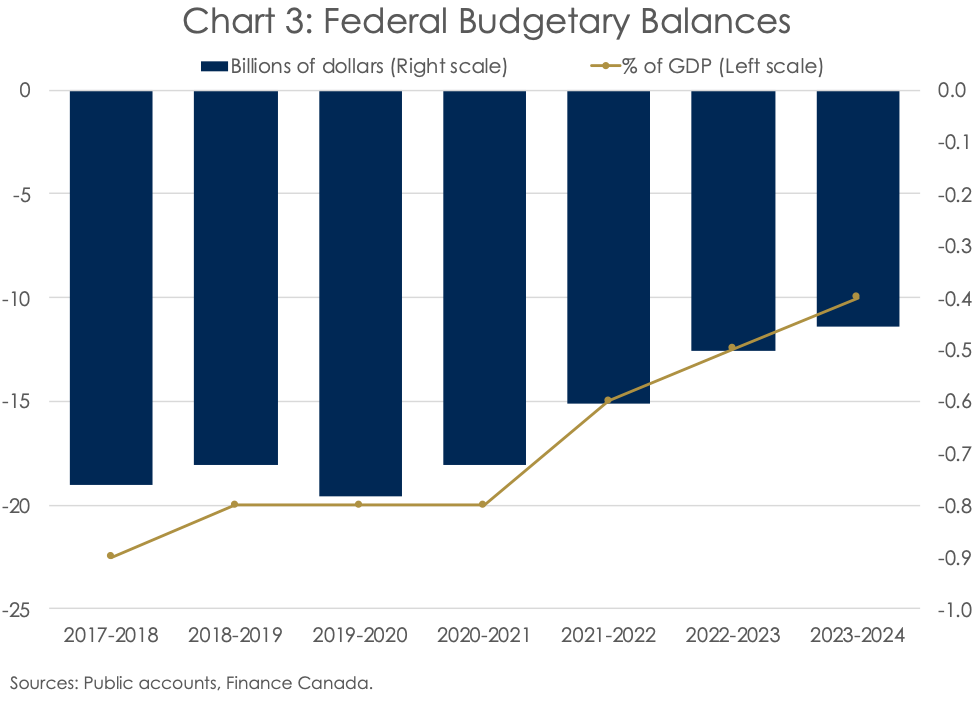

The Canadian economy has demonstrated remarkable resilience in 2018. Despite some risks to the economic outlook, positive medium-term growth is expected by all private sector forecasters (even though it is subject to some slowdown at times). In its 2018 Fall Economic Statement (FES), the federal government continued to project fiscal deficits over the next five years despite the positive economic developments. The Government is focused on the debt-to-GDP ratio as its fiscal anchor and is counting on the dynamism of our economy to achieve a declining -debt-to-GDP ratio over time. However, there appear to be economic headwinds that may make it difficult to achieve this target. (see Atsin and Page (2018) for a discussion of potential risks to the economic outlook).

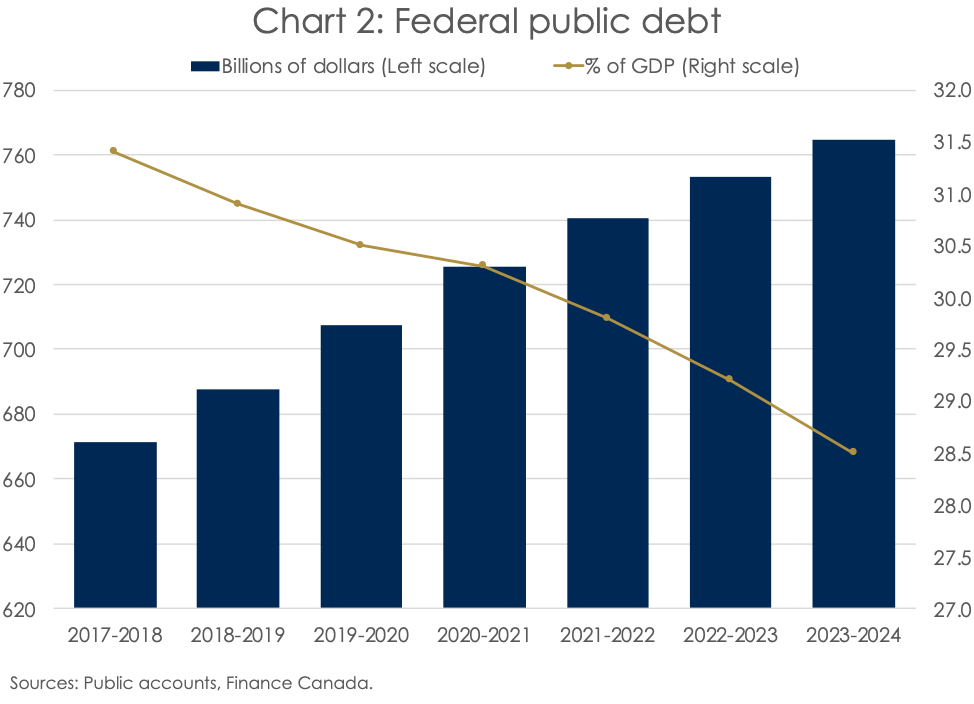

As of fiscal year, 2017-18, the federal public debt amounted to $ 671 billion (accumulated deficit = net debt less non-financial assets), according to the Public Accounts. The Government predicts that the debt will increase by almost $ 83 billion over the next six years, although the ratio of public debt to GDP is expected to fall slightly, thanks to continued strong economic performance.

Higher interest rates relative to what the Government is now projecting are likely to divert the government from its financial trajectory (year over year declines in budgetary deficits), leading to a more significant deficit in the medium-term. However, what is more worrisome is that the government now has less leeway to respond to an economic downturn or shocks. The wiggle room used to reduce taxes and increase spending in a low-interest rate era is coming to an end.

Even the modest deficits projected by the new federal budget can contribute to a much higher burden on the public debt. While Canada is not on the brink of a financial crisis, the history and theory of business cycles have demonstrated that governments, in financial terms, should act with caution.

As we get closer to the upcoming budget season, more questions about the appropriateness of the budget deficit will be raised. Economically speaking, with an economy operating at or above its potential for several quarters now, and Canada’s unemployment rate at its lowest level in 40 years, this should be a time to lower the debt burden and follow a more prudent fiscal policy due to the growing risks to the economic outlook.

Concerns can darken the Outlook.

If a downturn occurs: are we able to cope? The answer would be yes, of course, through fiscal stimulus measures, but not without recourse to more public debt. The debt-to-GDP ratio will grow as the economy shrinks and the deficit rises.

Deficits impose an increasing burden on future generations, as it contributes to higher interest rate payments that must be financed. The implication is that a larger share of future revenues must go to paying interest on the debt. In the simplest terms, every dollar paid to finance the debt is a dollar that is not available for other vital priorities such as health care or social programs (especially when considering the spending increases needed to keep up with Canada’s aging population).

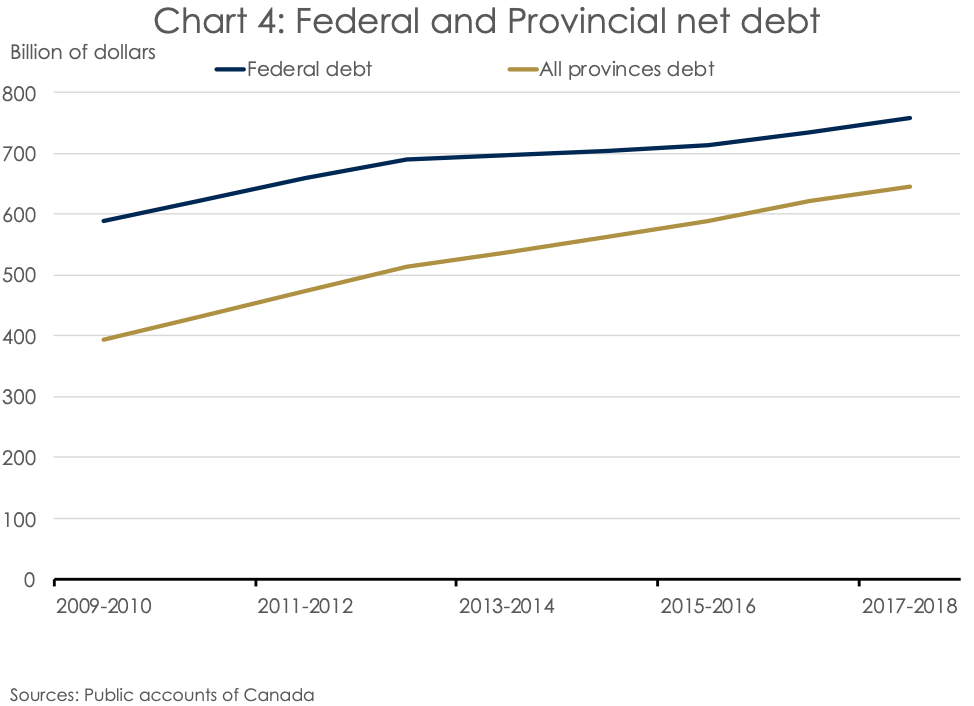

Furthermore, the rapid accumulation of debt at the provincial level raises concerns about the debt sustainability of all governments together. If the federal government accelerates its debt accumulation, and the provinces maintain their current pace, this could result in a substantial increase in the overall level of combined debt left to future generations of Canadian taxpayers for service and repayment. According to chart 4, the federal net debt (Total liabilities - Financial assets) is 29% higher in 2017-18 than it was in 2009-10 (from $ 588 billion to $ 759 billion). Total provincial net debt, on the other hand, showed a substantial increase of 64% over the same period (from $ 394 to $ 646 billion).

Finally, the experience of the early 1990s should serve as a compass so as not to make the same mistakes of the past. During that period, large and increasing deficits led to a vicious cycle of rising debt and deficits. The continuing increase in public debt had substantially impacted risk premiums on Canadian bonds, pushing up interest rates (Fillion, 1996)[6]. An increase in the cost of debt servicing followed this. The increase of interest on debt payments caused the deficit to grow even larger and, consequently, the total debt increased. As a result, federal finances became unsustainable.

In Conclusion

Maintaining a deficit and financing it through a growing public debt involves risks. As public debt increases, more resources will be directed toward interest payments and away from public spending that improves the daily lives of Canadian households, or the economic competitiveness of our economy. As we approach the budget season and governments begin to unveil their tax and spending plans for the future, they should take into account the risks of chronic deficits and rising debt.

[1] For more information about the department of finance, see: https://www.fin.gc.ca/fin-eng.asp

[2] For more information about the Bank of Canada, see: https://www.bankofcanada.ca/about/

[3] This term refers to the Bank of Canada.

[4] More details here: https://www.bankofcanada.ca/markets/about-financial-markets/

[5] See Table 1 and table 2 in the Debt Management Report 2017-2018 for more information: https://www.bankofcanada.ca/stats/goc/results/en-goc_tbill_bond_os_2018_12_31.html

[6] More details here: https://www.bankofcanada.ca/wp-content/uploads/2010/05/wp96-14.pdf