by Kevin Page and Aimeric Atsin

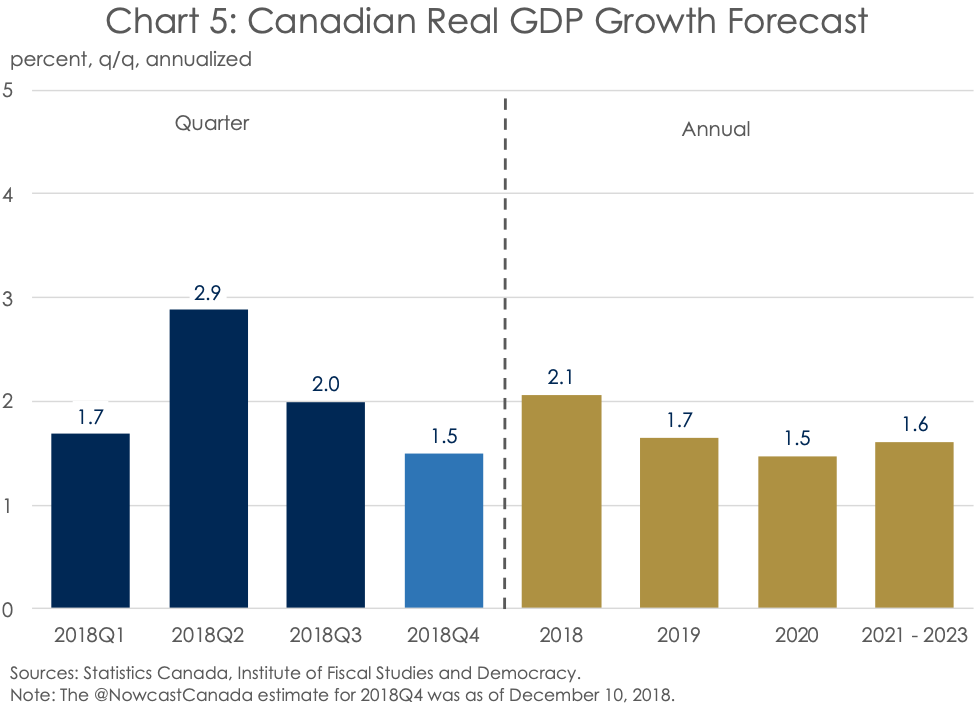

After growing at a healthy pace in the first three quarters of this year, the Canadian economy is estimated to have slowed down in the fourth quarter, reflecting the impact of lower oil prices and global trade tensions.

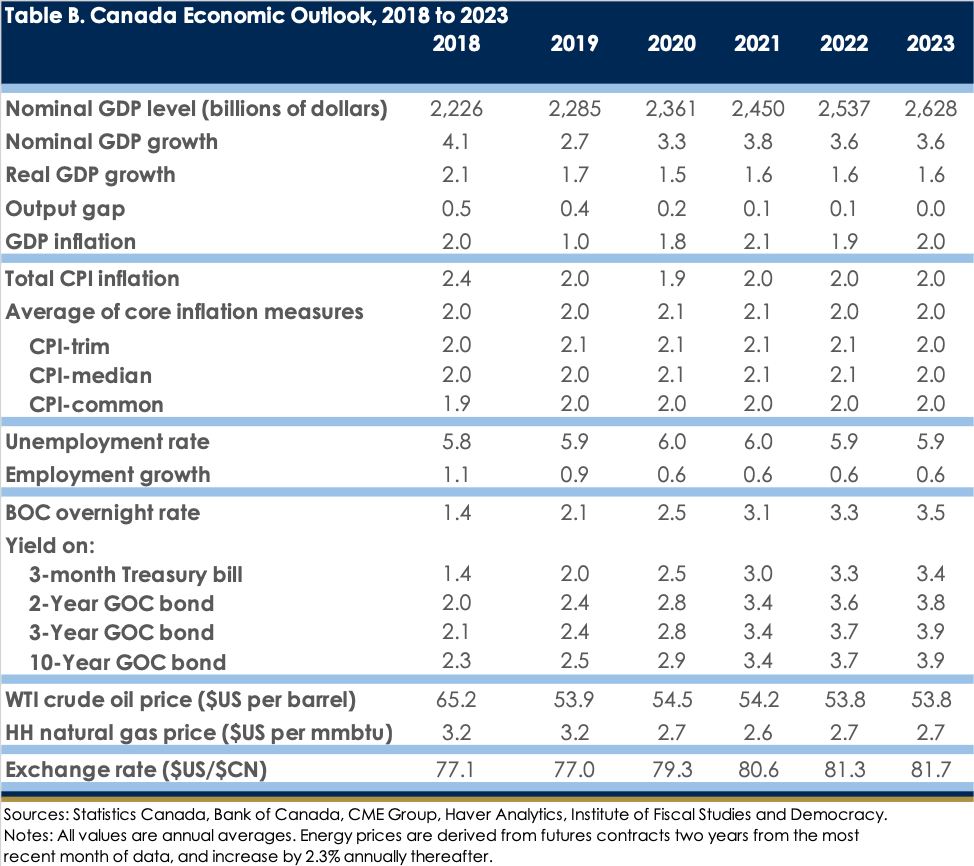

Given this lower growth momentum going into the next year, the IFSD expects real GDP growth to decline from 2.1 percent in 2018 to 1.7 percent in 2019. Despite the lower growth, real GDP is estimated to remain above its trend level in 2019. Thereafter, growth is expected to remain stable at 1.6 percent, gradually bringing real GDP closer to its trend level by the end of the forecast period.

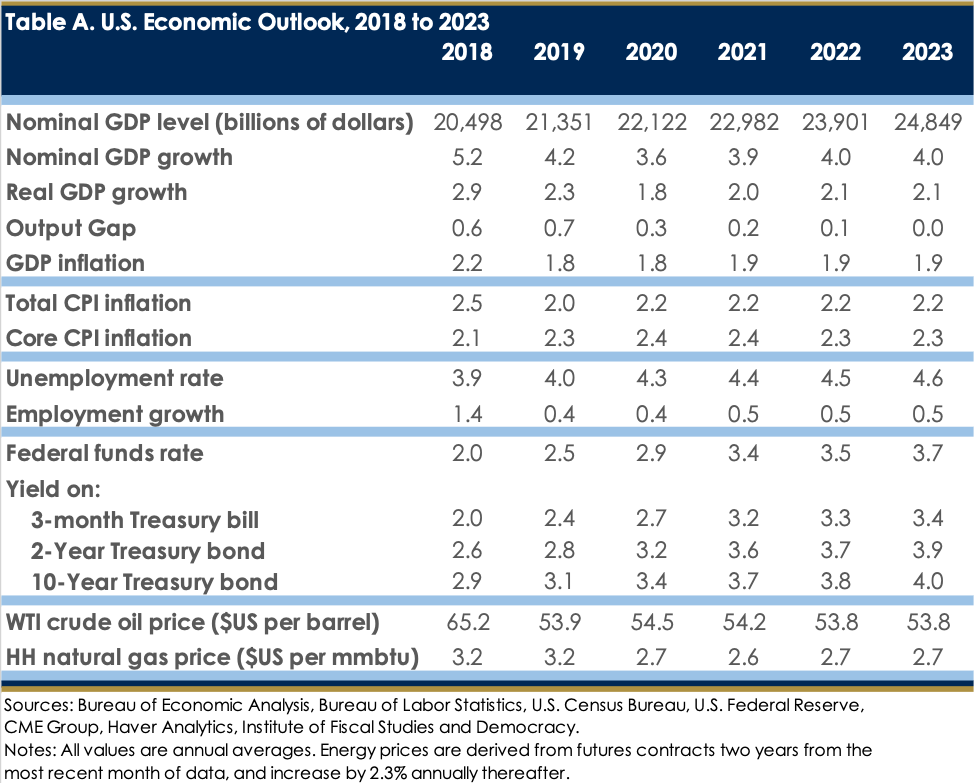

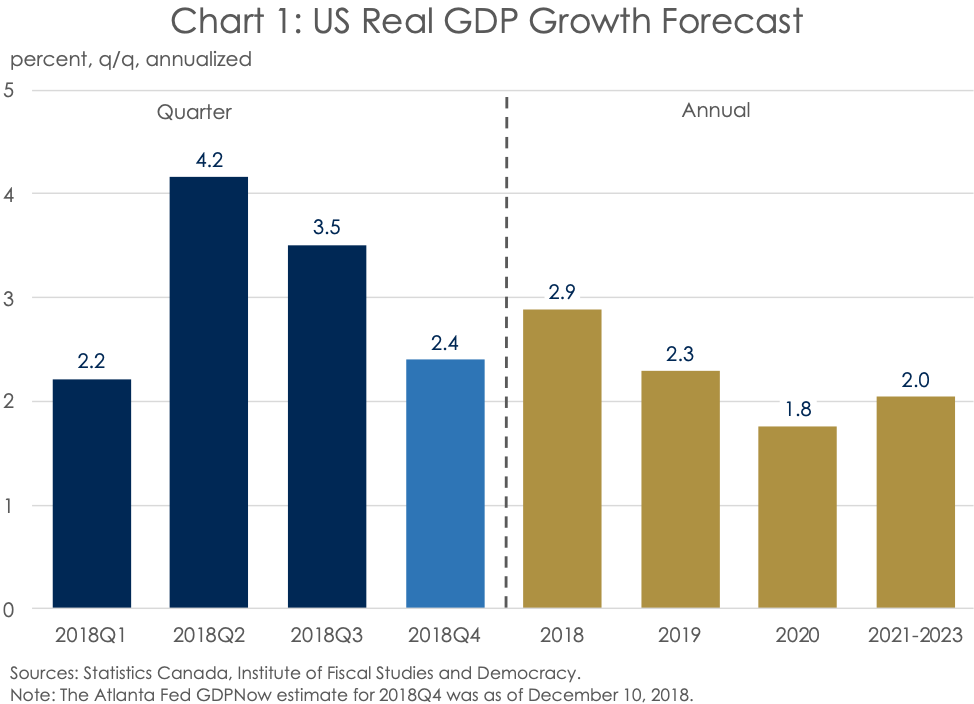

The U.S. economy continues to show strength

In the United States, growth is estimated to have peaked at 2.9% in 2018, supported by the continued impact of lower tax rates and stronger private business investment. Looking forward, growth is expected to slow to 2.3 percent in 2019 before falling to 2.0 percent on average over the rest of the forecast period as the impact of the fiscal stimulus measures dissipates.

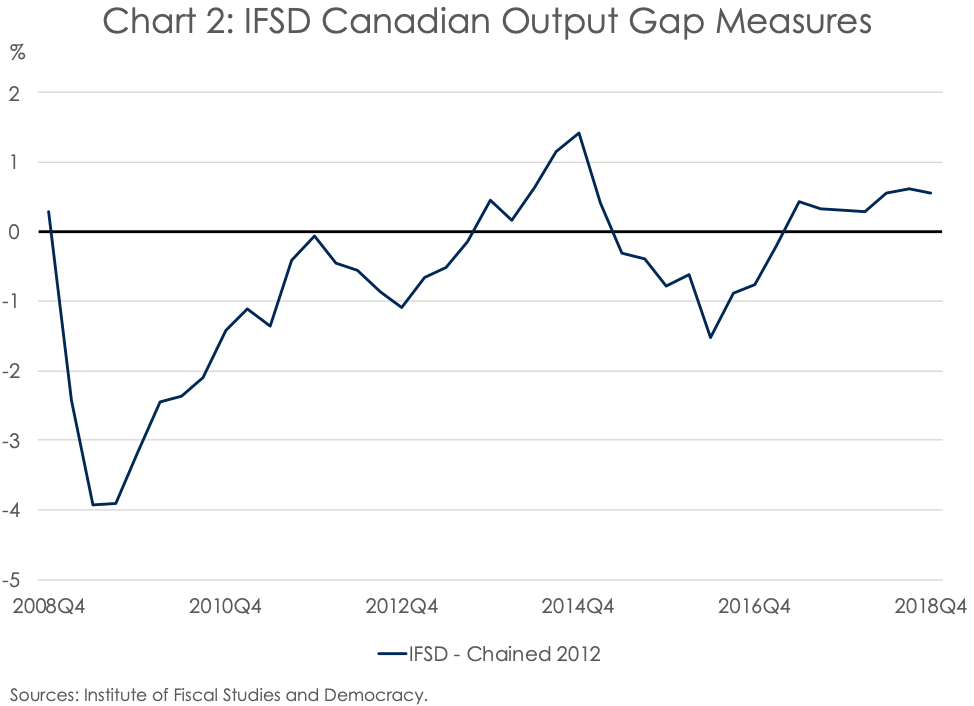

In Canada, real GDP remains above its trend level.

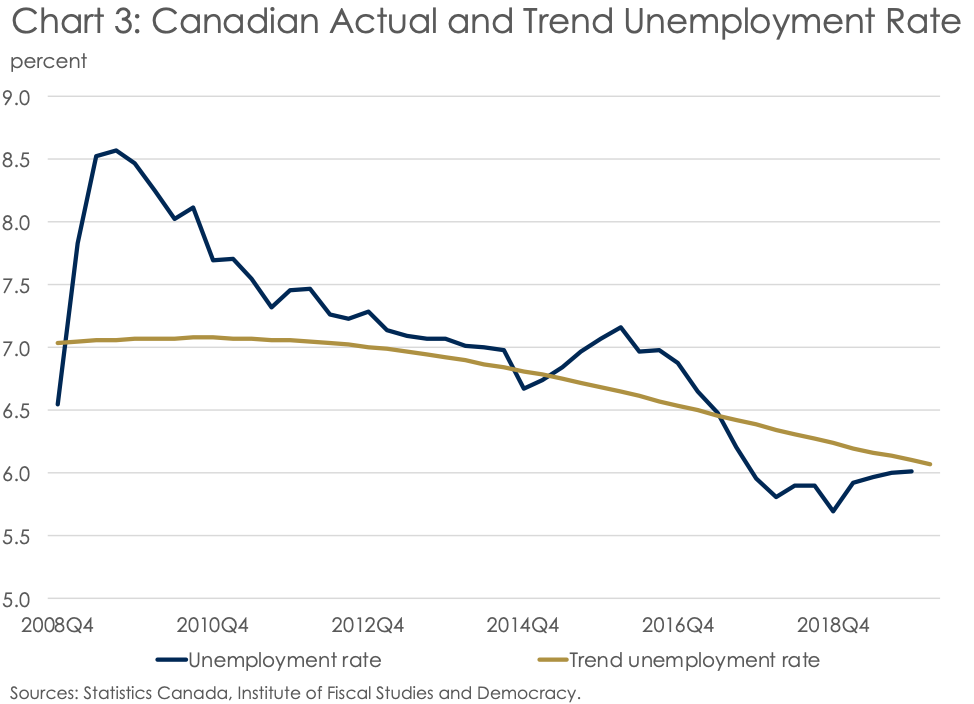

Strong growth in Canada over the past two years has pushed real GDP above its trend level resulting in a positive output gap (actual GDP minus potential GDP) and historically low unemployment rates. As a result, there has been a slight tightening of monetary conditions by the Bank of Canada over the past year. The bank rate is expected to increase gradually over the rest of the forecast period.

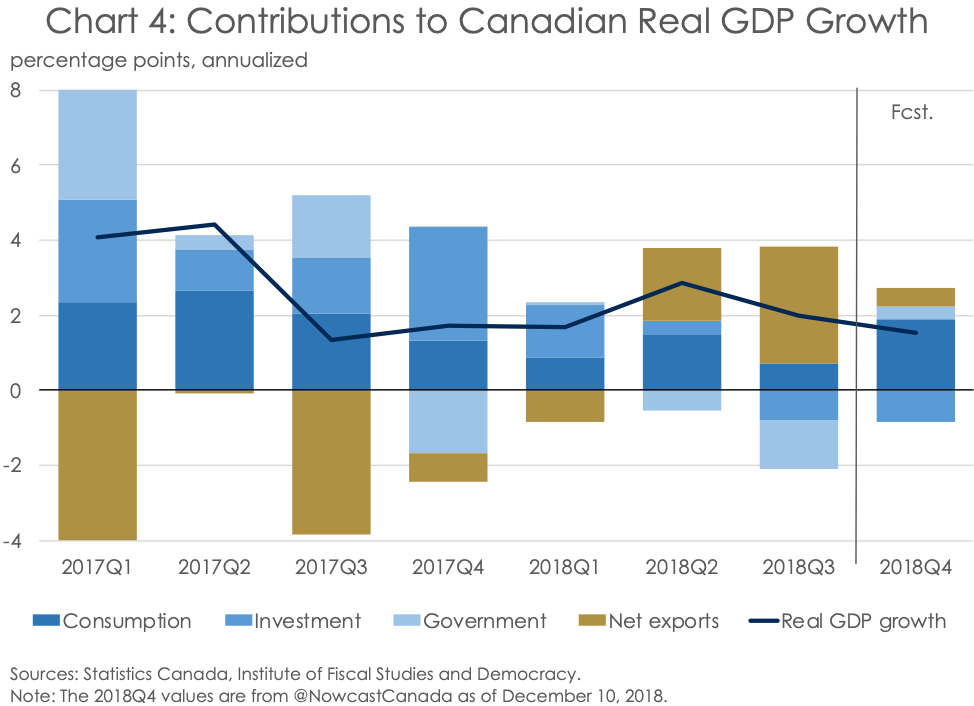

The rebalancing of real GDP growth from consumer spending to exports and investment that was observed earlier in 2018 seems to have been short-lived. Monthly indicators for the fourth quarter show that consumption will be the primary driver of economic growth. The contribution of net exports to real GDP growth drops significantly, and business investment is estimated to detract from growth. The latter is likely partly due to the drop in crude oil prices and the widening of the gap between West Texas Intermediate (WTI) and Western Canadian Select (WCS) oil prices.

The estimated weakening in growth in the fourth quarter will weigh on the expected real GDP growth in 2019. The IFSD expects growth to fall from 2.3 percent in 2018 to 1.7 percent in 2019 and 1.6 percent over the rest of the forecast period. With this growth profile the output gap is estimated to gradually decline. By the end of the forecast period the Canadian economy will be performing at its trend level, and the unemployment rate will return to its trend level of about 6 percent.

The significant drop in crude oil prices leads to a deterioration in the terms of trade, which negatively affects economy wide prices (GDP inflation). We expect GDP inflation to average only 1 percent in 2019 before rising to 1.8 percent in 2020 and 2 percent over the rest of the period.

Nominal GDP is projected to advance by 2.7 per cent in 2019, 3.4 percent in 2020 and 3.6 percent thereafter.

Consistent with this outlook of the real economy, CPI inflation is expected to return to 2 percent in 2019 and remain at that level over the rest of the forecast period.

Risks to the Canadian forecast

The IFSD believes that its forecast for the Canadian economy is the most likely outcome. However, there are both upside and downside risks to the outlook. On the upside, if the new trade agreement with the United States is ratified and the U.S. resolves its trade disputes with China and other countries Canadian exports and investment will be stronger.

On the downside, if the excess supply of crude oil does not shrink quickly, crude oil prices will likely fall below the current forecast. Moreover, it is likely that the drop in global crude oil prices will be accompanied by a further discount in the Canadian crude oil prices. This will lead to a further weakening of investment and production in the oil sect.

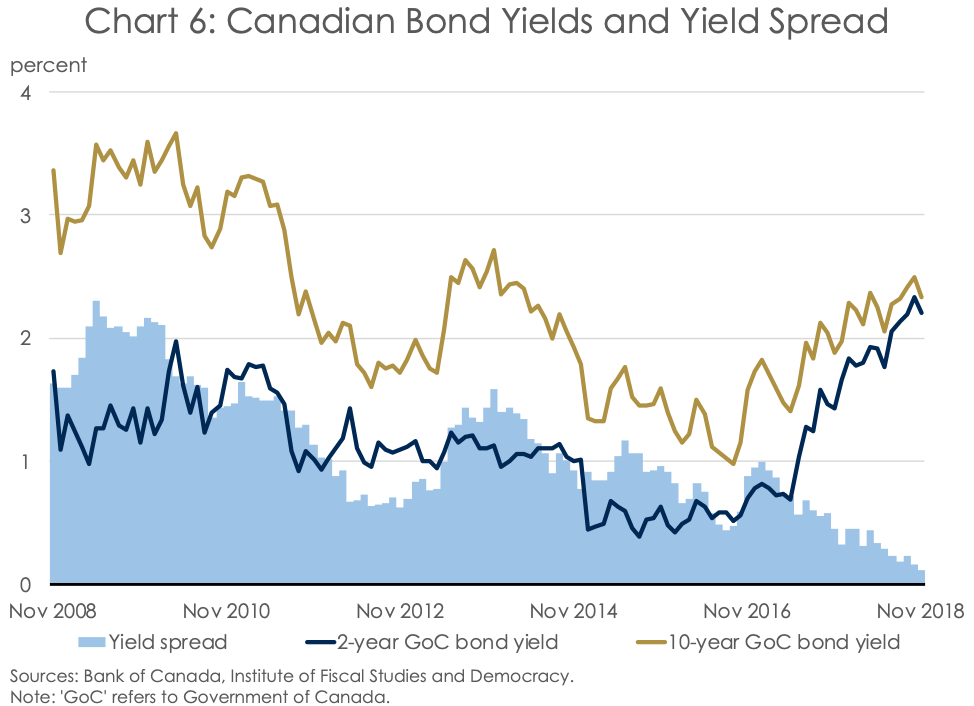

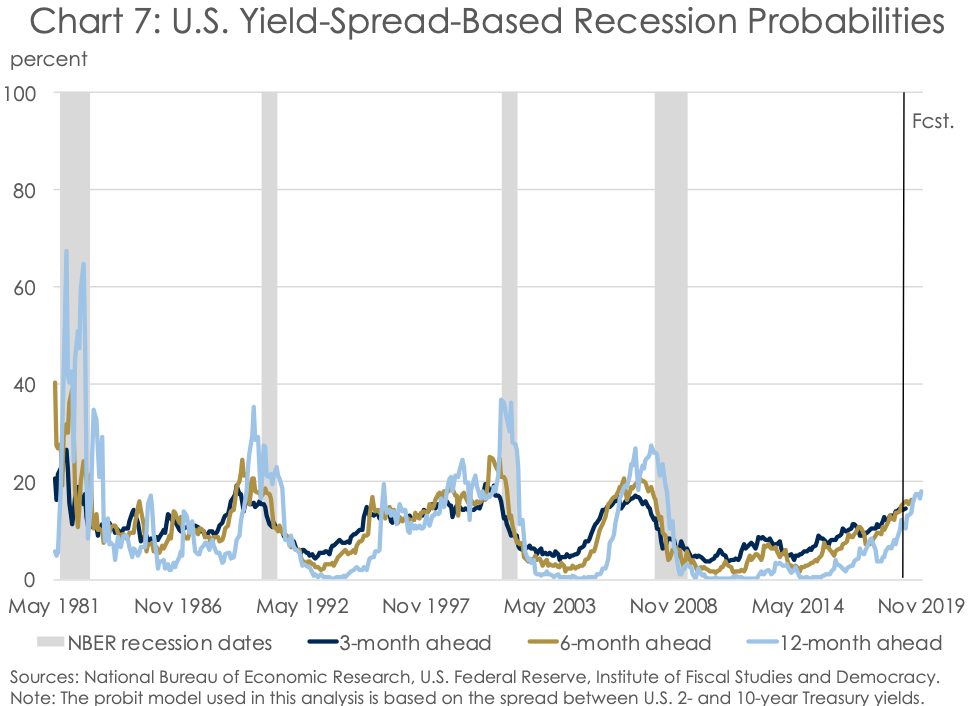

Another concern is the significant narrowing of the spread between short and long-term bond yields. Generally, a flat or inverted yield curve points to an impending slowdown in the economy. The last time the Canadian economy experienced such a low term spread was in 2007 and early 2008, which was followed by a severe recession.

In our baseline outlook, we do not expect the yield curve to be inverted. Our analysis using a basic PROBIT model, designed by the IFSD and based on 10-year and 2-year US Treasury bonds, indicates that an inversion of the yield curve and a downturn is very unlikely in the near term. However, given the very low spreads that we are experiencing now, it is prudent to consider the possibility of a significant slowdown in growth.

If these risks to the outlook are materialised they can have significant implications for the Government’s fiscal planning. On the upside, stronger than expected growth would provide more fiscal room to introduce new measures or reduce the budget deficit. On the downside, the substantial decline in oil prices is already placing pressure on the budget balance. PBO estimates that the decline in oil prices relative to the Fall Economic Statement’s baseline assumption could increase the budget deficit by $3.5 billion on average over the next 5 years. if there is a further decline in crude oil prices or a downturn for other reasons, the Government will face significant fiscal pressures and will need to rethink its economic and fiscal strategy.