by Randall Bartlett

No matter how you slice it, 2017 was a standout year for the Canadian economy. Real GDP growth hit 3%, the unemployment rate touched its lowest level in decades, and inflation remained below the central bank’s 2% target. Characterized as the ‘sweet spot’ by Bank of Canada Governor Stephen Poloz, this robust economic activity prompted two interest rate hikes in 2017, and another in January 2018, as central bankers adopted a cautionary, and now gradual, approach toward monetary policy normalization.

But despite these positive economic tailwinds heading into 2018, an undercurrent of uncertainty has hung over the Canadian economy, particularly as it pertains to trade. The vitriol that has surrounded the North American Free Trade Agreement (NAFTA) since President Donald Trump’s inauguration has now begun to manifest itself in material trade barriers. Indeed, it was recently revealed that a draft of a renegotiated NAFTA has been rejected by President Trump, accompanied by references to Canada and Mexico being “very spoiled” and “difficult to deal with”. He has also threatened to slap a 25% tariff on imported vehicles under Section 232, an obscure provision in U.S. trade law that permits tariffs to be placed on imports considered a national security threat. This is in addition to President Trump having introduced tariffs of 25% and 10% on U.S. imports of steel and aluminum, respectively. Until recently, temporary exemptions from these tariffs were granted to Canada, Mexico, and the European Union. But, last week, President Trump refused to extend them, triggering a response in kind from these jurisdictions.

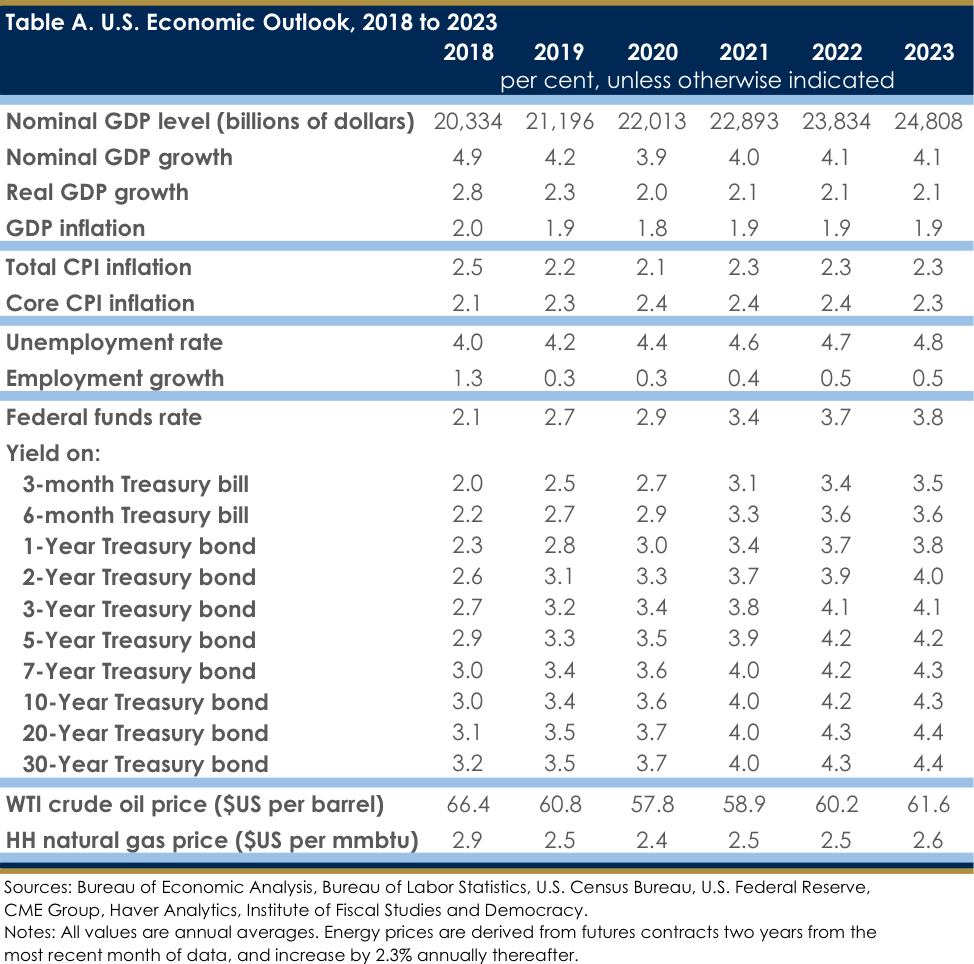

These tariffs, and those that have been threated, will have material impacts on the Canadian economy, most notably for the provinces in Central Canada. For instance, with around 80% of Canada’s iron and steel exports to the US coming from Ontario, you can bet that these tariffs will take some of the shine off of Ontario’s strong economic performance of the last couple of years (Chart 1). A similar fate awaits Quebec, Canada’s newest fiscal darling, which is the origin of nearly two thirds of Canada’s aluminum exports to the US. And if motor vehicles become subject to tariffs, over 90% of which come from Ontario, the recent economic strength of Canada’s largest province could fade into the rear-view mirror.

In the face of these external threats to Canada’s economic prosperity, it is imperative that Premiers recommit this summer at the Council of the Federation meeting in New Brunswick to taking concrete steps to further reducing internal trade barriers in Canada. Indeed, in the Concluding Statement of its recent Article IV consultations with Canada, the International Monetary Fund (IMF) highlighted that “Federal and provincial governments should do more to reduce inter-provincial barriers to trade and the free-movement of skilled labor. Regulatory red-tape remains substantial despite CFTA (Canadian Free Trade Agreement).”

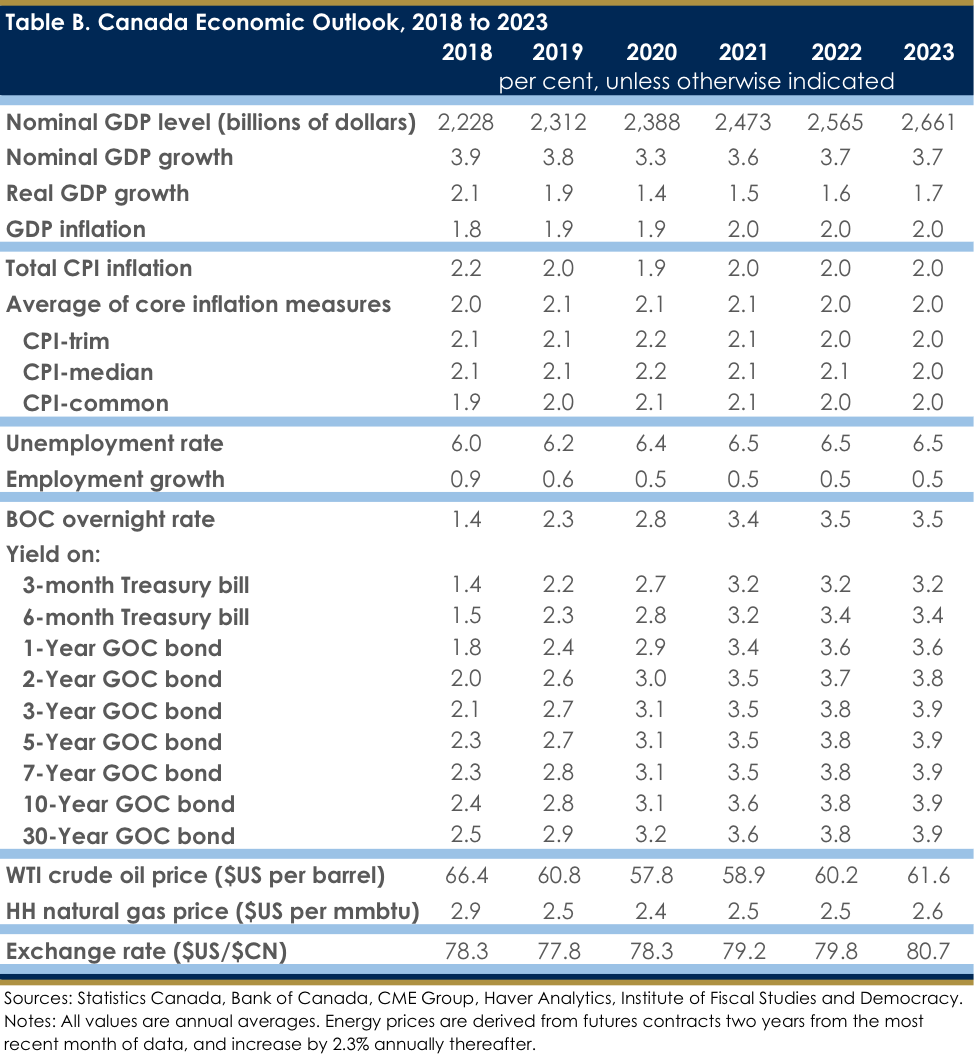

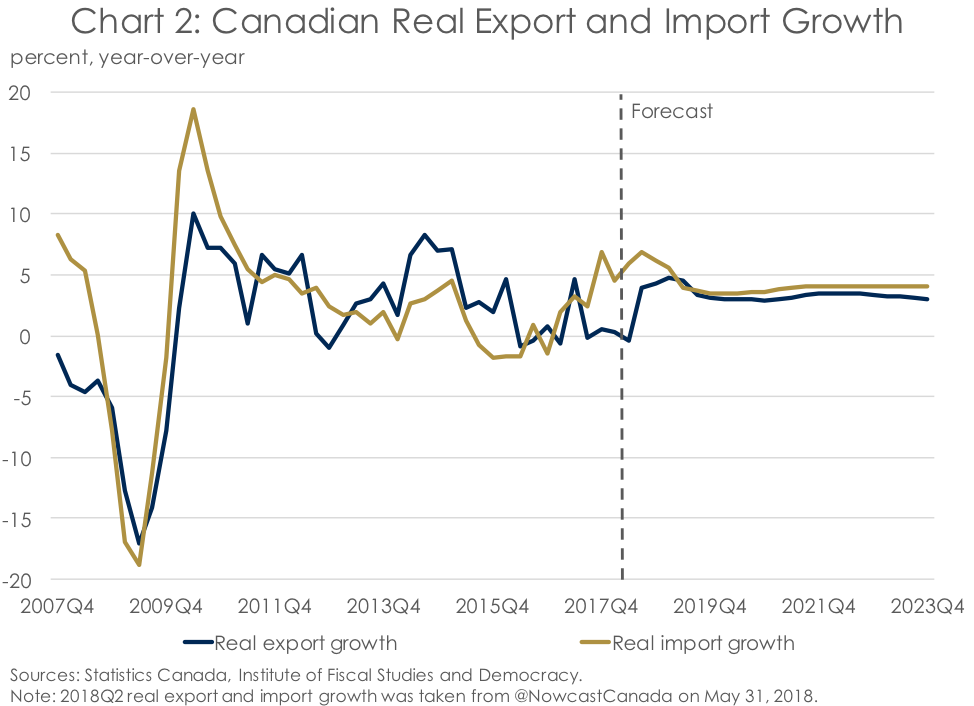

However, with mid-term Congressional elections rapidly approaching, hope springs eternal that the current momentum in favour of more Democrats making their way to Washington could derail some of the President’s plans to disrupt global trade. This more ‘status-quo’ scenario for trade is the one that the Institute of Fiscal Studies and Democracy (IFSD) has included in its forecast. As such, the IFSD’s outlook points to some rebound in real export growth in the coming quarters, converging to the pace of real import growth after being in the dumps over the past year (Chart 2).

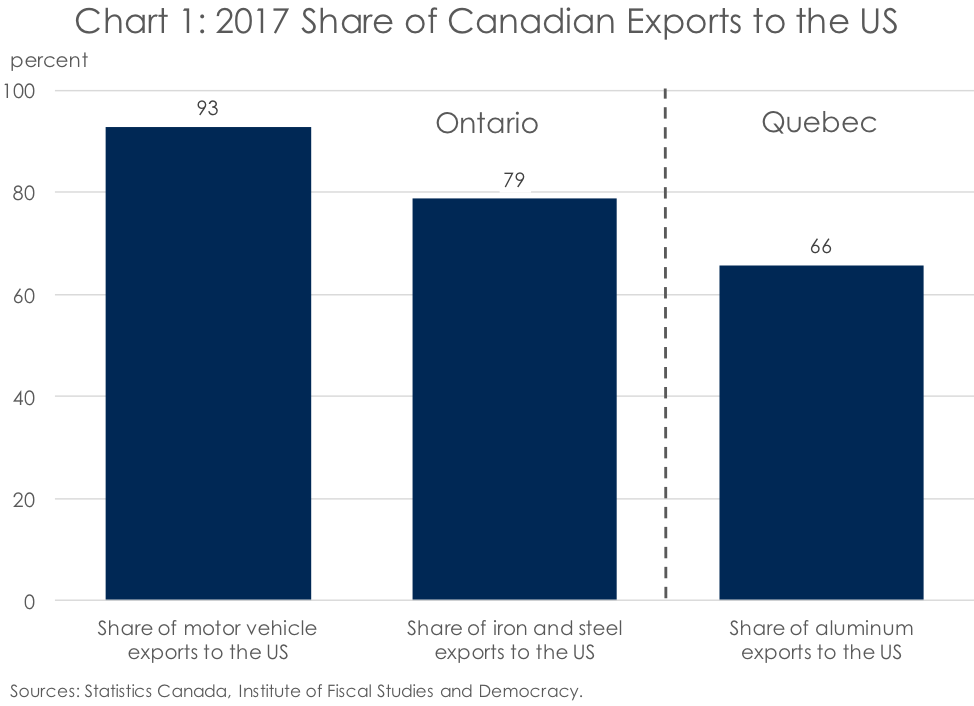

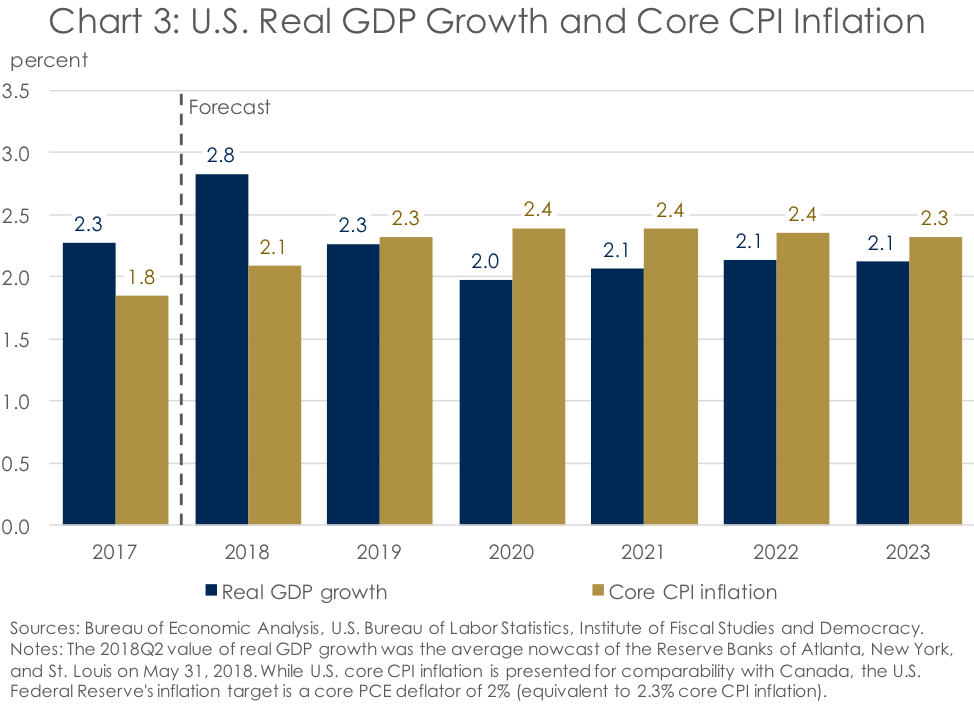

The IFSD’s relatively optimistic forecast for trade is also premised on continued economic strength stateside (Chart 3). Indeed, with anticipated U.S. real GDP growth of 2.8% in 2018, the IFSD’s U.S. outlook is in line with other forecasters. And as the U.S. output gap – the level of real GDP as a share of potential GDP – moves into positive territory, inflation should continue to converge toward the U.S. Federal Reserve’s target. This is a positive development for a country that has struggled to generate price growth, particularly wage growth, and should support a gradual return to normal monetary policy as interest rates edge higher. (For the IFSD’s detailed U.S. economic forecast, see Table A.)

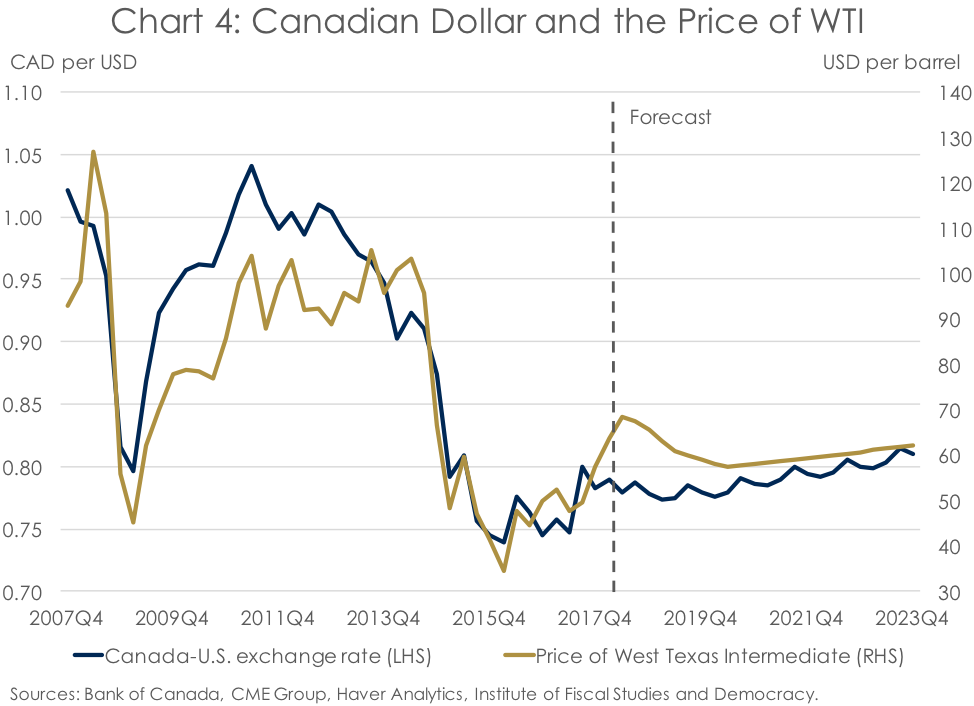

Further supporting Canadian exports is the recent run up in oil prices, which will benefit Canadian energy producers by fetching a higher price for their product (Chart 4). This is particularly the case as the discount paid to Canadian producers for heavy crude has narrowed in recent months toward more typical levels. Meanwhile, the gains in the price of oil has not been accompanied by a concomitant appreciation in the Canadian dollar, again supporting oil exports by keeping the price of Canadian-produced energy comparatively low.

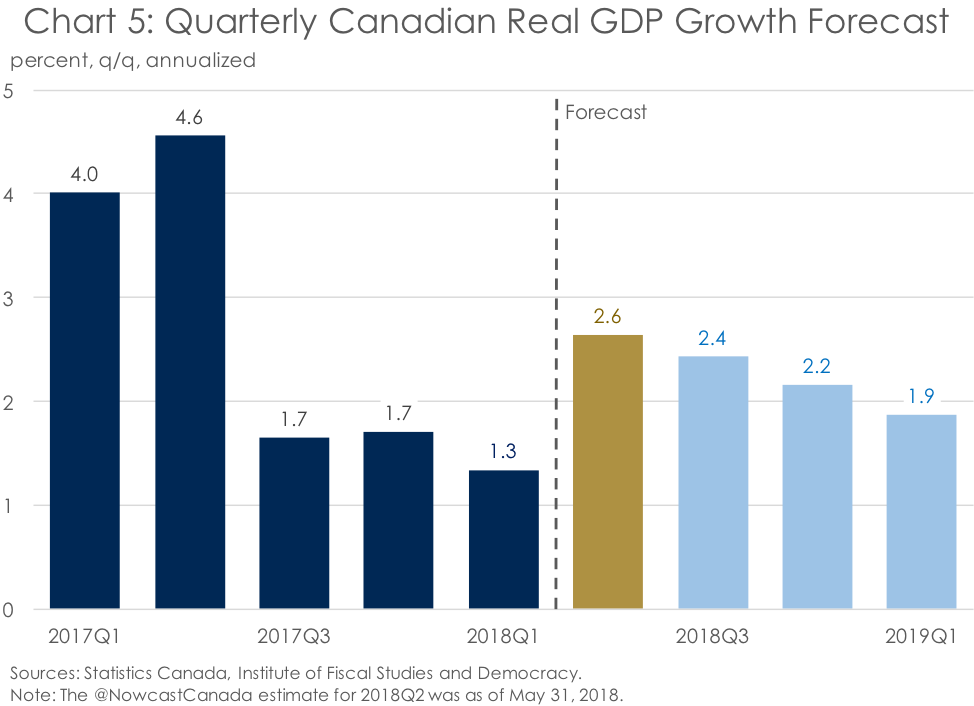

Stronger real export growth will help to support the advance in real GDP in the near term, although a continued solid pace of real import growth should temper the overall contribution to growth from trade. Instead, the above potential outlook for real GDP growth in the coming quarters is anticipated to be underpinned by the persistent strength of domestic demand. Indeed, real GDP growth is expected to clock in at north of 2% in each of the remaining quarters of 2018 (Chart 5). According to business surveys, investment is likely to continue to make a solid contribution to growth over the next year as firms come up against persistent capacity constraints. This after investment in machinery & equipment posted double-digit annualized quarterly gains in each of the past two quarters while many other expenditure categories contributed little to growth. At the same time, although comparatively weak in the first quarter of the year, household consumption is expected to bounce back in the remaining quarters of 2018. This will be supported by still highly accommodative monetary policy, solid income growth on the back of accelerating wage gains as the labour market remains tight, and the stabilization of a small number of large housing markets.

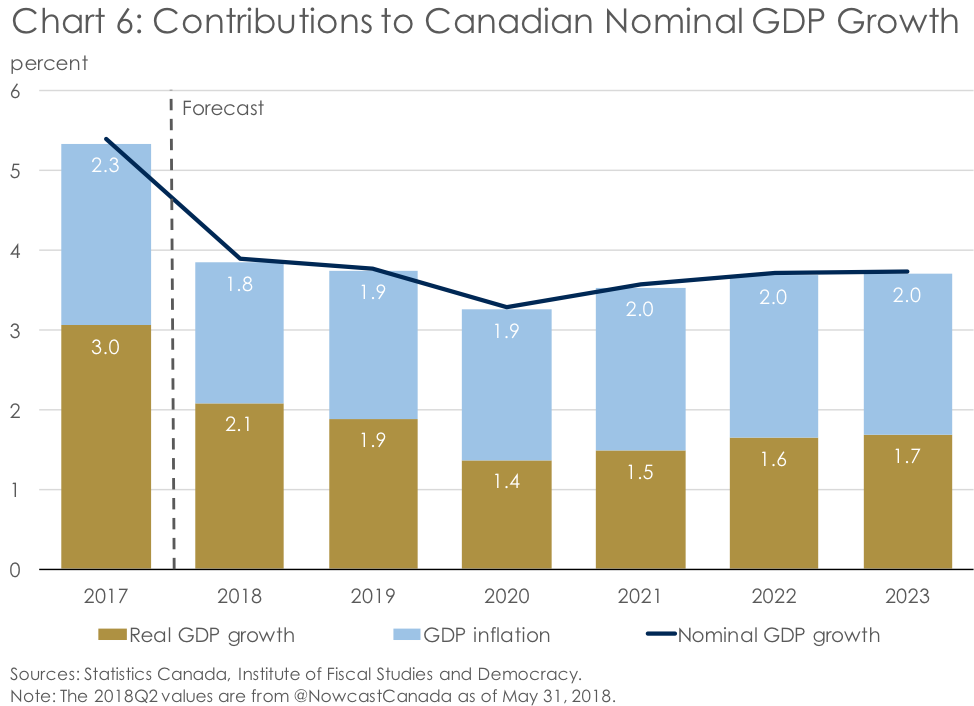

But the good times aren’t expected to last (Chart 6). After a 3.0% advance in 2017, the pace of real GDP growth is expected to slow to 2.1% in 2018 and 1.9% in 2019, as growth in domestic demand returns to more normal levels and the contribution from trade becomes more muted. Meanwhile, price growth is likely to moderate relative to its solid 2.3% clip in 2017, thanks to an anticipated pull back in oil prices and a gradual rise in the value of the Canadian dollar. (For the IFSD’s detailed Canadian economic forecast, see Table B.)

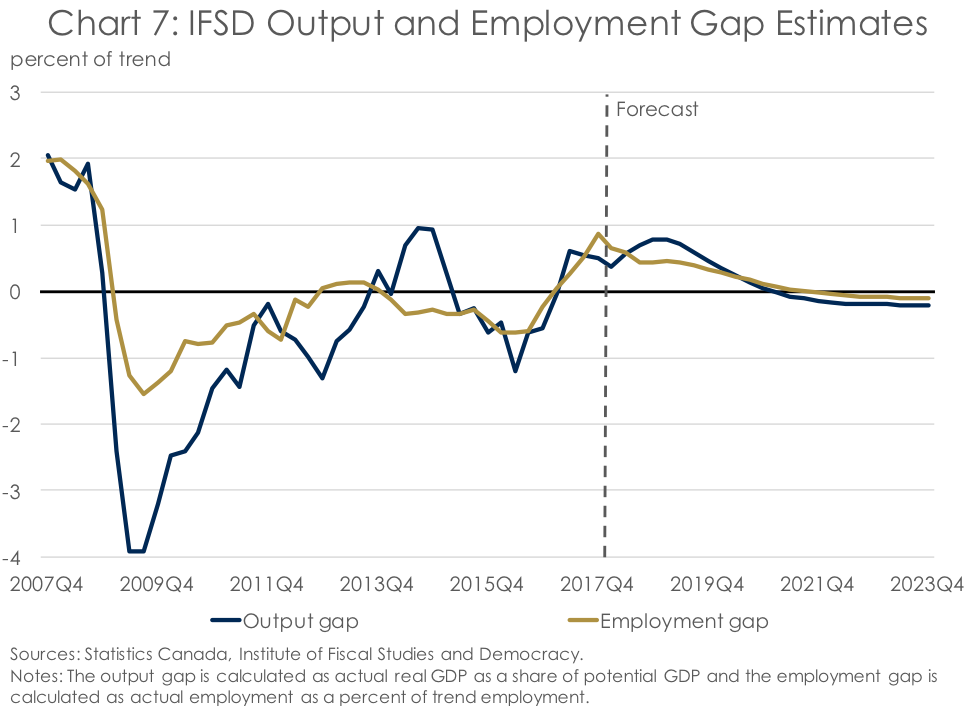

Starting in 2020, the outlook for real GDP growth becomes much more dismal, averaging around 1.5% annually for the remainder of the forecast. But this isn’t the reflection of an economy that has stalled. It instead reflects an economy and labour market that are expected to be operating above their potential – a phenomenon that cannot continue indefinitely (Chart 7).

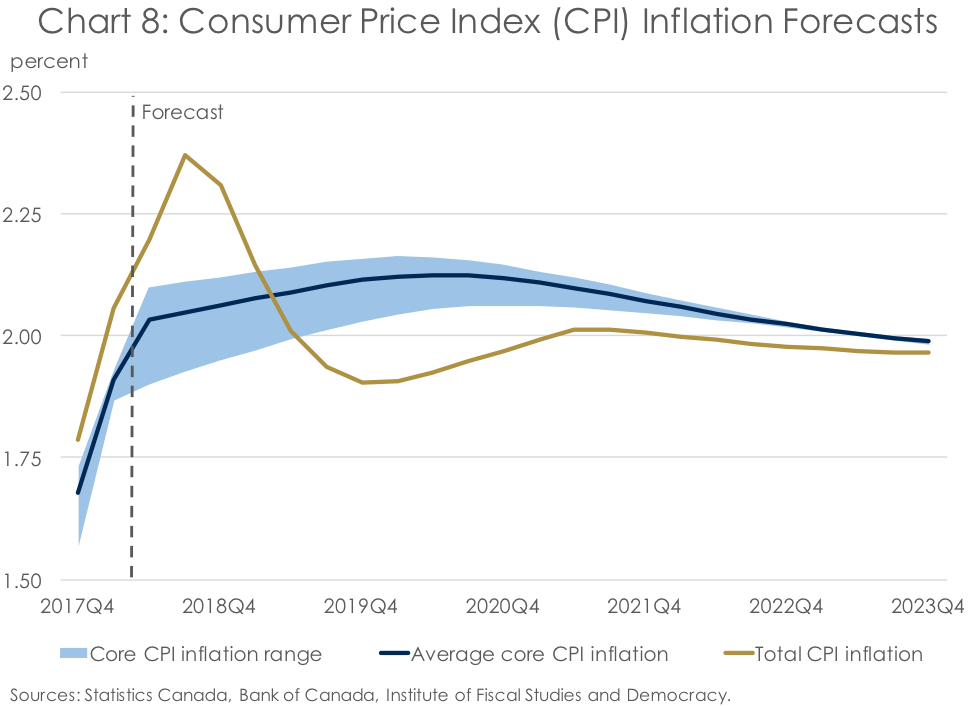

Economies and labour markets that are running hot have important implications for prices. As firms come up against capacity constraints, the first response is generally to hire more workers to meet short-term demand. Increased demand for labour pushes up wages as workers with the desired skills become more scarce. Ultimately, rising wages make their way into general prices in the economy, causing underlying inflation to rise. In accordance with this view, the IFSD anticipates that core CPI inflation will rise somewhat above the Bank of Canada’s 2% inflation target over the next few years (Chart 8). Meanwhile, total inflation is also anticipated to top 2% in 2018, although this is in large part driven by higher gasoline prices, a phenomenon that is expected to reverse over the next couple of years.

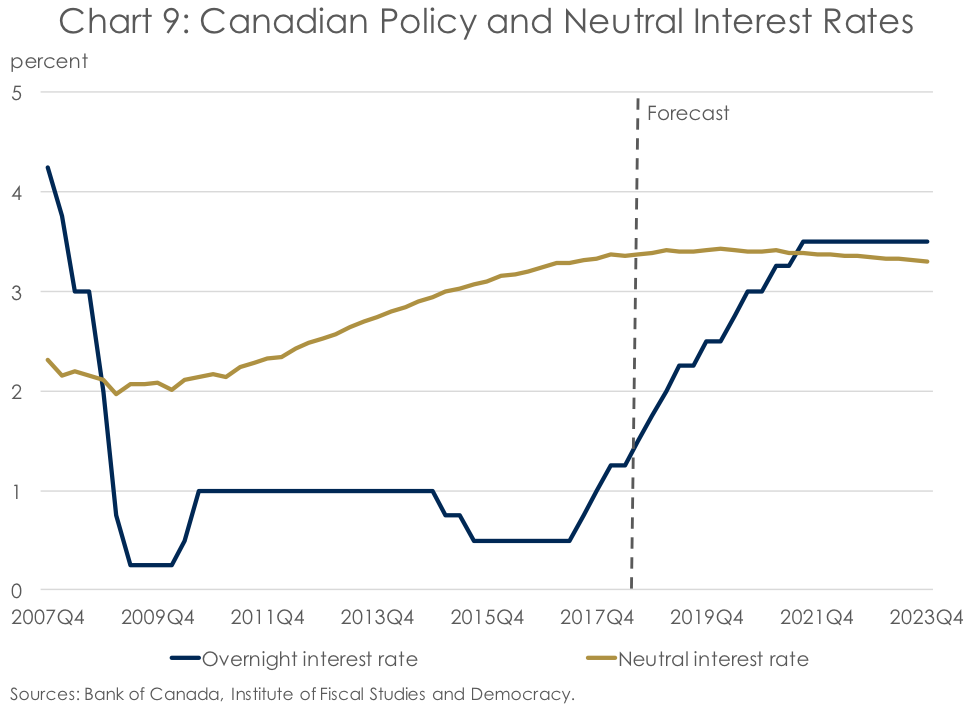

This said, a moderation in real GDP growth and inflation doesn’t just happen. Instead it reflects a further tightening in monetary policy by the Bank of Canada to prevent the Canadian economy from overheating too much. With the Canadian economy and employment currently residing above their respective trend levels, underlying wage growth and core CPI inflation will continue to accelerate. As such, despite the uncertainty around trade negotiations with the US and the vulnerability of highly-indebted households in Canada, the Bank of Canada will be forced to raise interest rates to keep inflation contained around the Bank’s 2% target. In line with financial markets, the IFSD is expecting the Bank of Canada to raise interest rates by 25 basis points at each of the July and October 2018 fixed announcement dates (Chart 9). An additional rate hike in each of the first two quarters of 2019 is also anticipated, with the pace of rate hikes becoming more gradual thereafter. But while rate hikes should slow the advance of growth and inflation in Canada, monetary policy is expected to remain accommodative until the very end of the IFSD’s medium-term forecast.

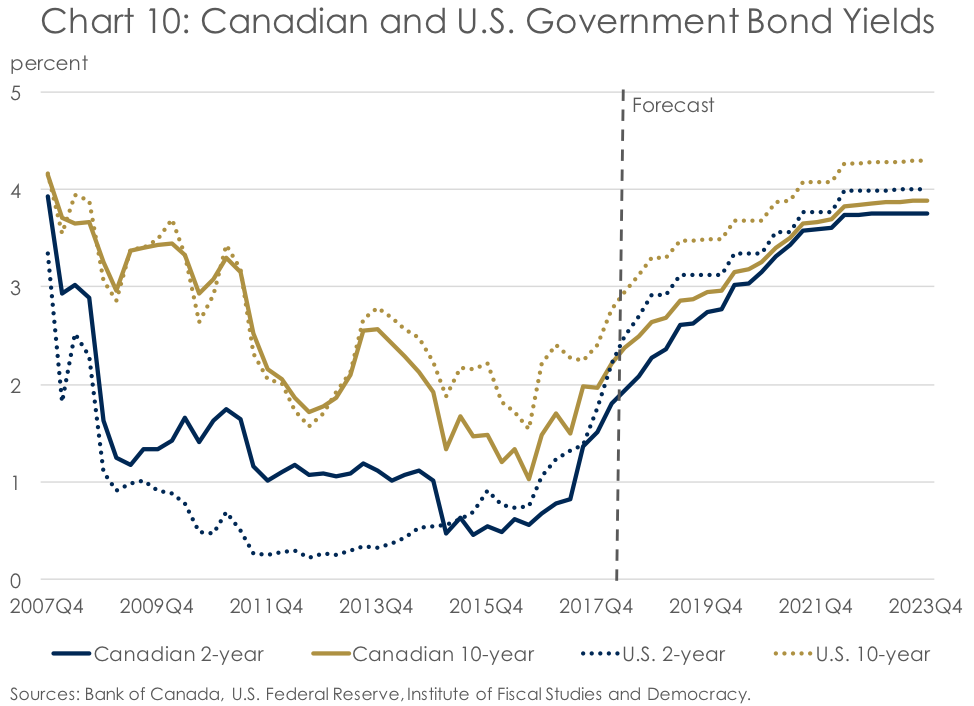

And it’s not just short-term interest rates that are expected to move higher in Canada. Longer-term interest rates are also anticipated to climb, albeit more slowly. Consequently, the Canadian yield curve is expected to flatten considerably, broadly mirroring the outlook for U.S. interest rates, although it is at no time anticipated to become inverted (Chart 10). This general rise in interest rates will have profound implications for the Canadian economy, given the highly-leveraged nature of Canadian households. Indeed, the rise in interest rates observed over just the last year has contributed to rising borrowing costs and the recent deceleration in the pace of both residential mortgage and consumer credit growth. In contrast, U.S. households are much less leveraged than their neighbours to the north, with growth stateside being better able to continue at a solid pace against a backdrop of rising interest rates as a result.

Conclusion

Despite the turbulent trade environment currently facing Canada, the domestic economic and labour market outlook remain robust and should support further monetary policy tightening by the Bank of Canada. The US is anticipated to grow even that much faster, supporting a higher but flatter yield curve on both sides of the border and rising borrowing costs as a result. And while the actions of President Trump have been antagonistic toward all U.S. trading partners, including Canada, a shift in the balance of power in Congress following the mid-term elections this fall could support more certainty ahead. But, until then, the world waits for sanity to be restored.